Car Insurance Gst Malaysia

The insured business claims the GST back from the taxation department as a credit when filing the next GST return. So yes while there are multiple opinions as to how rendering the GST zero-rated would affect the price of goods and services in general in Malaysia whats for certain is that The Malaysian economy measured by the indicator gross domestic product GDP has grown by 54 year-on-year in the first quarter 1Q of 2018 owing to the continued.

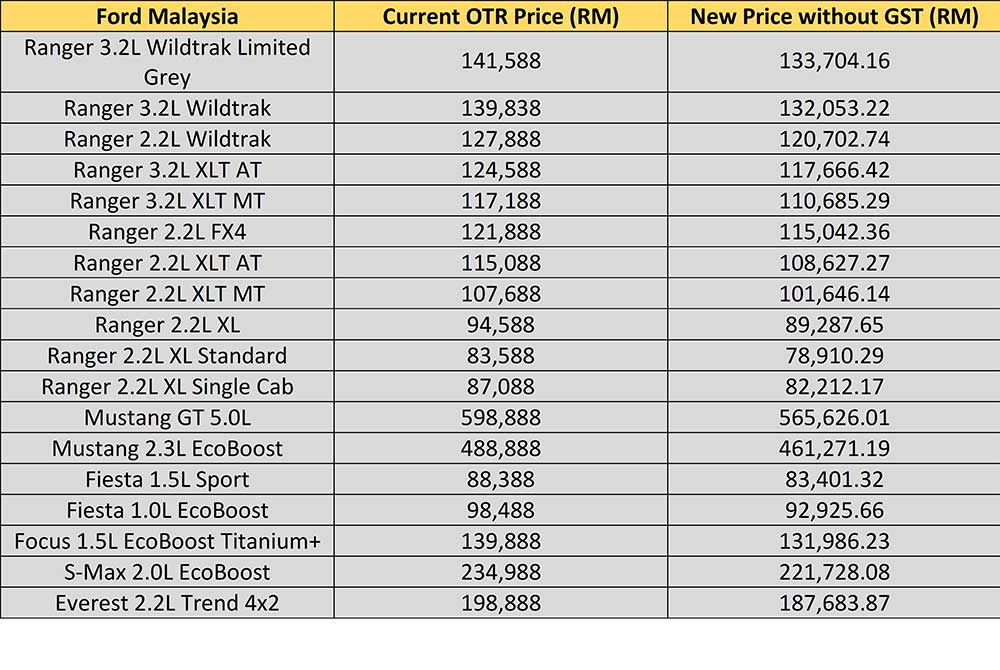

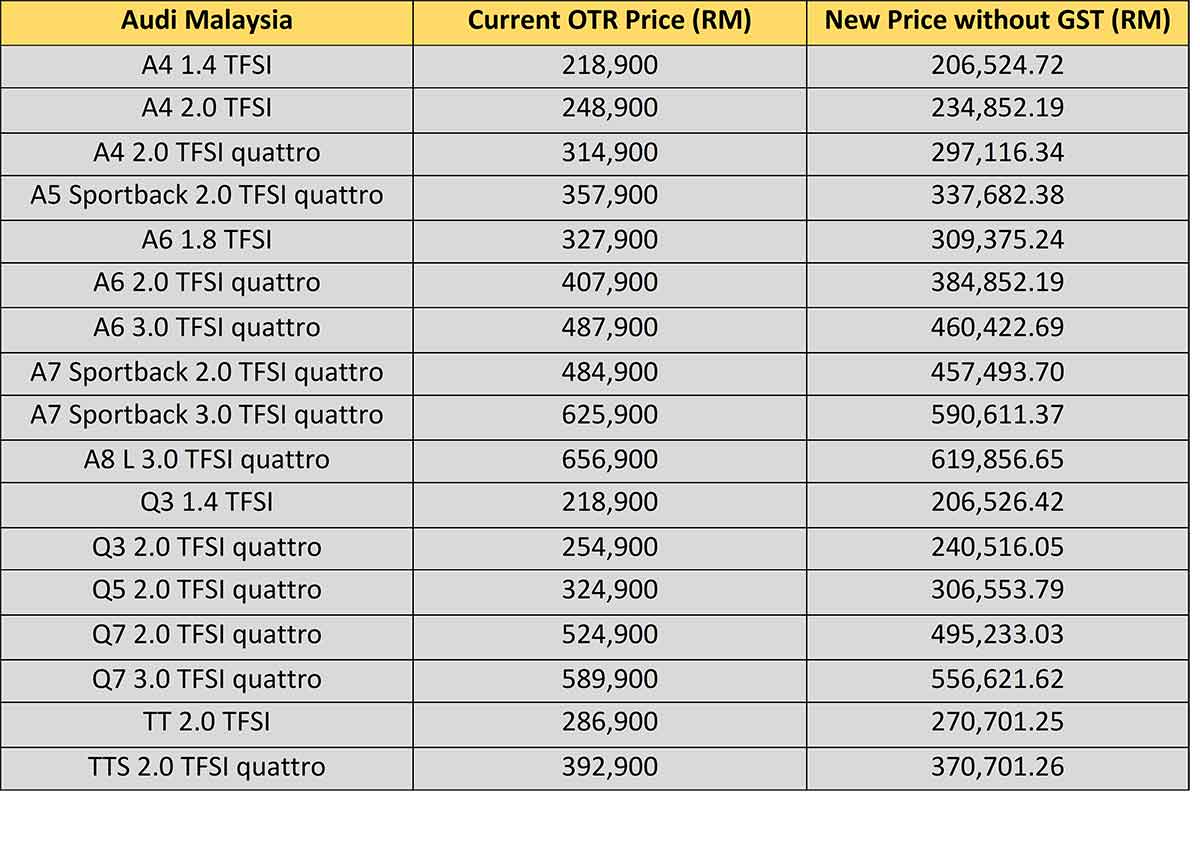

2018 Car Price In Malaysia Without Gst

15 x 125 RM 1780 6 GST.

. For example if a car is involved in an accident and the cost of repairs including GST comes to 1100 the insurance company only pays 1000 of the cost of the repair and the GST-registered car owner claims back the 100 GST. The conventional insurance contracts that they are economically equivalent to. As a part of preparing for Malaysia Thailand Border Crossing By Car Or Motorcycle getting insurance coverage for vehicles is very important.

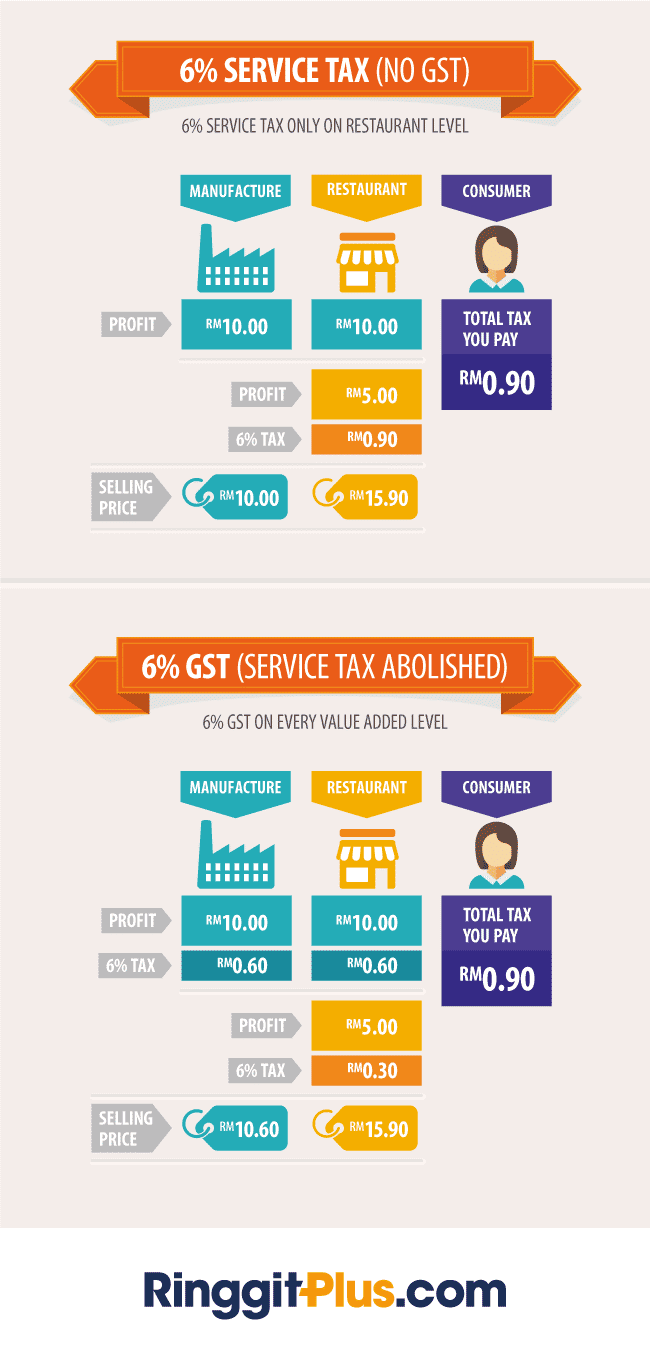

Malaysia June 30 2013 From as far back as 2005 the idea of introducing a Goods and Services Tax GST regime in Malaysia has been bandied around its merits and drawbacks mentioned discussed and heatedly debated. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. Malaysia is keen on reintroducing a goods and services tax GST as it attempts to expand its revenue base and carry the weight of public subsidies.

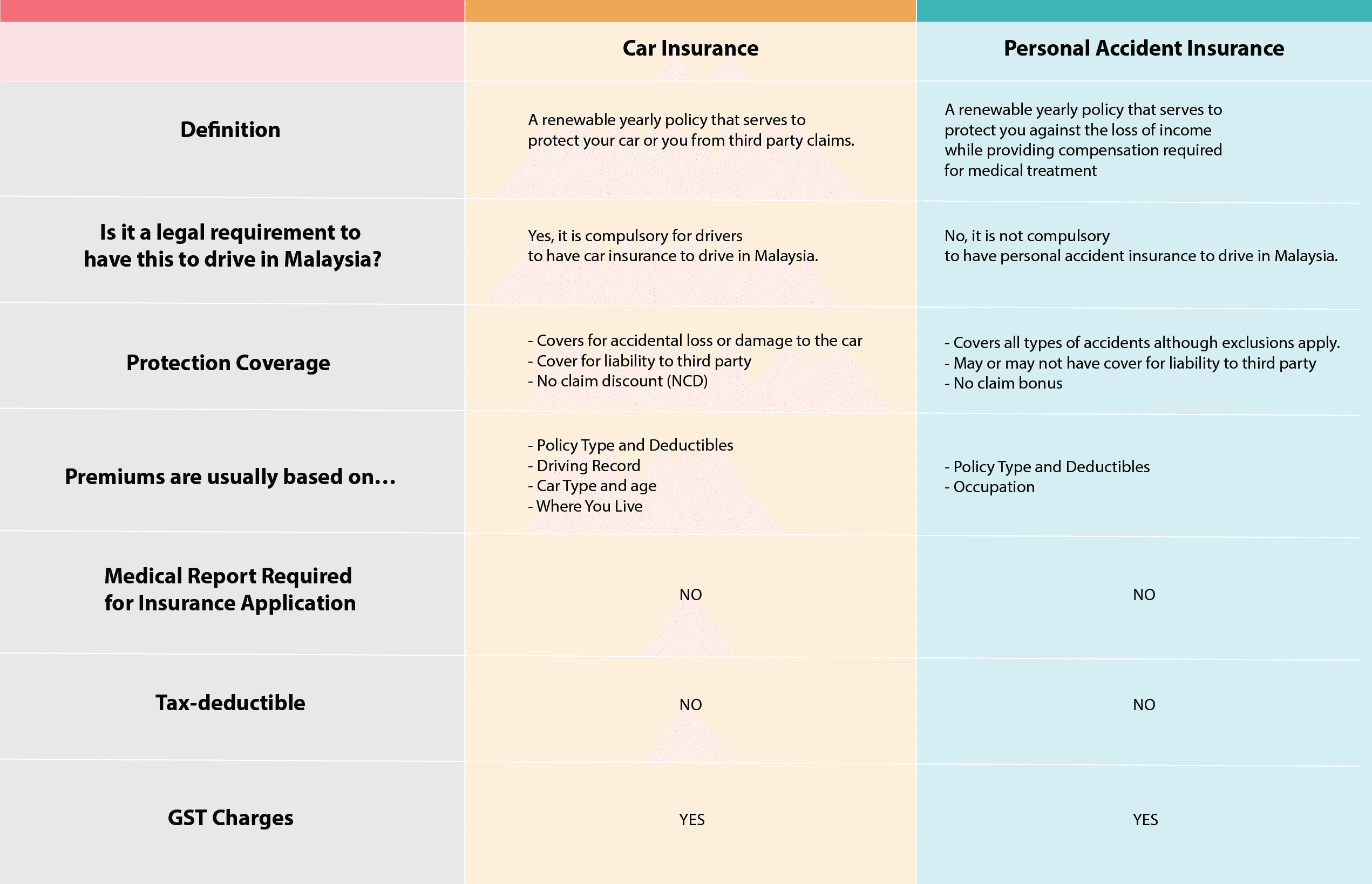

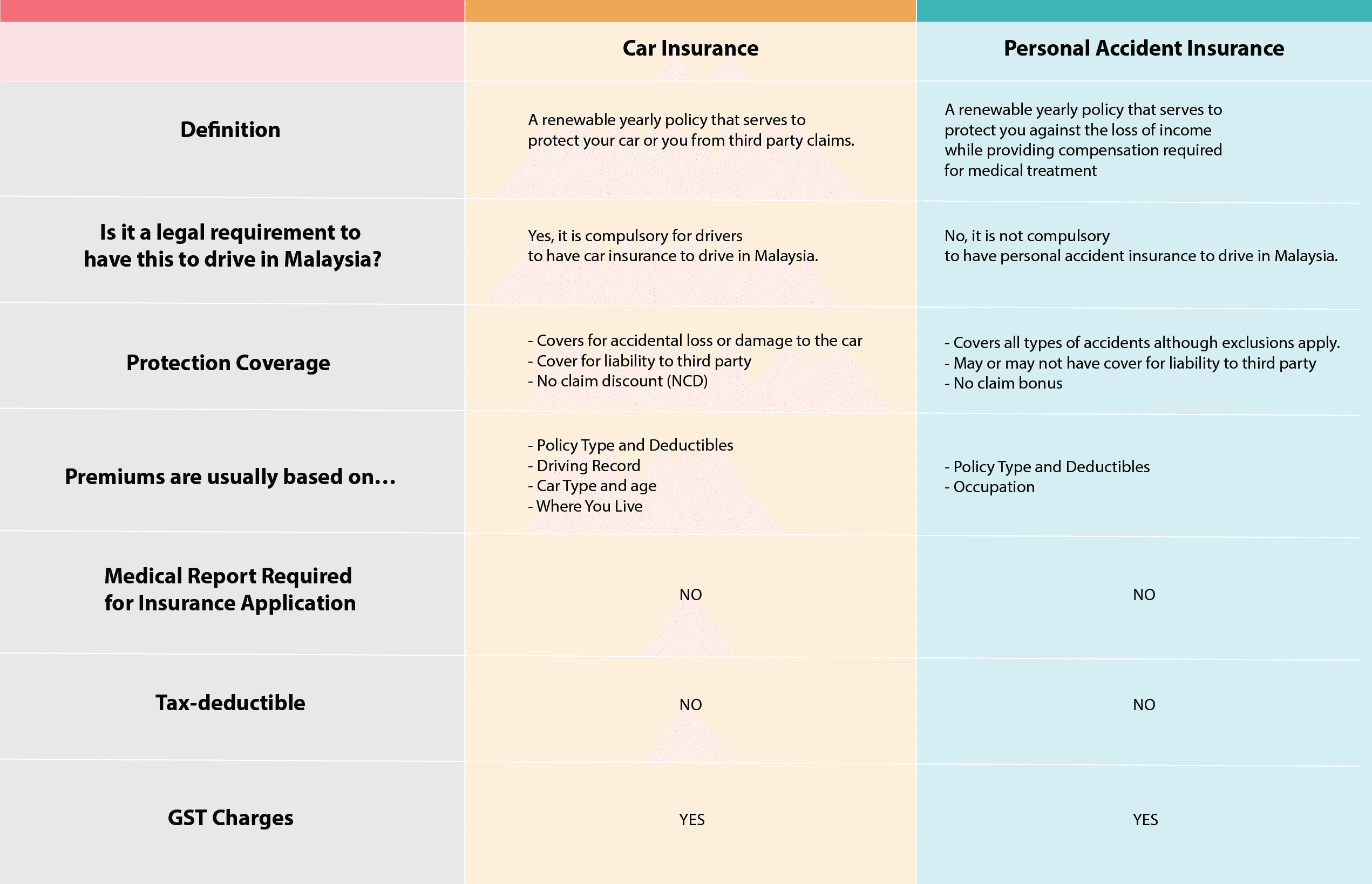

General insurance or general takaful provides short-term protection of properties and liabilities against any loss or damage. It applies to most goods and services. While most car companies are seeing healthy order banks few have enough cars to fulfill these orders before the cutoff date of 30-June 2022 a direct result of the ongoing global shortage of automotive electronic parts.

For GST purposes general insurance means an insurance contract assigned to the general insurance fund designed. Insurance in respect of a property in Malaysia Section 213f Insurance services supplied directly in. Youll find prices specifications warranty details high-resolution photos expert and user reviews and so much more packaged in a user-friendly intuitive layout that is easy to read.

The two reduced SST rates are 6 and 5. Those who had been travelling in Thailand knew how complicated it can be if one is involved in an accident especially when you dont have insurance coverage. According to the Road Transport Act of 1987 all vehicle owners are required to have car insurance in Malaysia and road tax in order to legally drive on the road.

25 From 1 Jan 2020 a GST-registered insurance company who procures services from overseas suppliers imported services and is either not entitled to full input tax credit or belong to GST groups that are not entitled to. For instance if youre a solid driver with a good track record you can save money over time by not making claims from your insurer. The move to reimplement GST which replaced the.

Heres a table on the NCD rates for car insurance in Malaysia. If you are caught driving without a road tax you are breaking the law and may be fined up to RM 3000 under Section 144 of the Road Transport Act RTA 1987. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and.

If youve just booked a 2022 model chances are you wont get it until July or August.

2018 Car Price In Malaysia Without Gst

Best Car Insurance In Malaysia 2022 Compare And Buy Online

Gst Reimplementation Could Reduce Malaysian Car Prices Says Analyst But Is That Really The Case Paultan Org

2018 Car Price In Malaysia Without Gst

0 Response to "Car Insurance Gst Malaysia"

Post a Comment